Executive General Orders issued in 1915. To go back to the list of General Orders click here.

No. 191

12 July 1915

Executive General Order No. 191

It is hereby ordered and decreed that: –

1. Executive General Orders No. 69 and 89 shall not be so construed as to prevent the agents of the Government from appealing in any case, civil or criminal, to which it may be a party; and such right shall not be denied to the Government.

2. This order shall take effect on and from this date. Those parts of any law which conflict with the provisions of this order are hereby revoked.

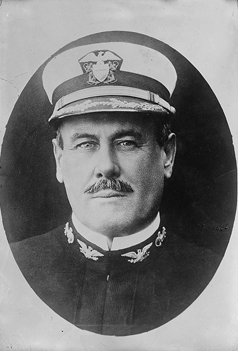

W. J. MAXWELL

Governor of Guam

No. 192

30 November 1915

Executive General Order No. 192

It is hereby ordered and decreed that: –

1. On and after January 1, 1916, a tax upon personal property of the inhabitants of Guam shall be levied, assessed, collected and paid into the Treasury of Guam in the manner and form hereinafter prescribed; and the purpose of such appraisement and taxation and collection, personal property in Guam shall be classed and taxed as follows; provided that the total amount of tax collected on any article for any one fiscal year shall not exceed 2½% of the appraised value of such article for that year:

Class I – Automobiles, motorcycles, motor trucks and all privately owned power propelled vehicles of every description of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-20 of 1%.

Class II – Motor boats, motor launches and all privately owned power propelled vessels of every description owned and operated by citizens of the United States or persons owing allegiance to and subjects of the United States or owned or acquired and operated by aliens prior to January 1, 1916, of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-20 of 1%; provided that no privately owned vessel of any character shall be allowed to engage as common carrier in the coastwise trade of Guam without a permit duly signed by the Governor of by his order.

Class III – Motor boats, motor launches and all privately owned power propelled vessels and vessels of every character and description owned and operated by aliens to the United States imported into Guam on and after January 1, 1916, of a value of $1,000.00 or less shall be taxed a the rate of 2% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-10 of 1%; provided that no vessel of any description owned wholly or in part by aliens shall be permitted to engage as a common carrier between any points or places of Guam.

Class IV – All power driven machinery of every description not named or placed within Classes I, II, and II of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-20 of 1%.

Class V – All precious stones and jewelry and articles of adornment which are manufactured or consist in whole or in part of gold, silver or other precious metals or of precious stones, which shall be imported into Guam on and after January 1, 1916, when of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-10 of 1%; provided that this provision shall not apply to any article owned and worn or used as the official insignia of any office or person.

2. Additions to the items in any class or changes in the classification of any item of personal property, including those items hereby made taxable shall, when necessary or required, be made by Executive Notice and the tax due to any such change shall be payable on April first next after date of issue of the Executive Notice placing such article or articles on the lists heretofore mentioned; and all such articles or classes of personal property as may be hereafter so added to those classified by this order shall be subject to the provisions of this law in the same manner as if those items had been originally included in and classified by this order.

3. For purposes of appraisal and appeal for such appraisal, Executive General Order No. 56, is hereby made applicable to taxable personal property.

4. The personal property tax imposed by this law shall be payable at Agaña on and after the first day of April of each fiscal year: but in every other respect the provisions of Executive General Order No. 114; now providing for the payment and collection of real estate taxes, are hereby made applicable to the payment and collection of the personal property tax now or hereafter imposed by this law.

5. All articles of personal property mentioned in this order of which may hereafter come under its provisions which are owned by officers or officials of the United States Government or by those of the Naval government of Guam are exempted from the payment of the tax imposed by this law if such articles of personal property and habitually used by them in the execution of their Governmental business.

6. The tax imposed by this law shall not be collected against any article of personal property of any licensed trader of Guam which is carried in his stock in trade, when such article is kept and held unused and has been acquired solely for sale to bona fide customer, but such articles which are used by any merchant or trader in the prosecution of this business or for his own private use or benefit shall be subject to the tax; provided that the word “unused” shall not be construed to prevent the operation of any article necessary to maintenance of good working order or for demonstration or such article to prospective buyer.

7. The tax imposed by this law shall not be collected upon any property owned and used by any charitable or religious organization or association or by any of the members and associates of such organization or association if such article or articles or personal property are required or intended wholly for use of or for the charitable or religious purposes for which such association or organization is duly founded, authorized or associated.

8. All laws and parts of laws inconsistent with the provisions of this order are hereby repealed.

W. J. MAXWELL

Governor of Guam

No. 193

14 December 1915

Executive General Order No. 193

It is hereby ordered and decreed that:

1. There is hereby created and established in the Treasury of the Naval Government of Guam a Division which shall be known as the Bank of Guam; which shall be a depository for the purpose of conducting the fiscal business of the Naval Government of Guam in accordance with paragraph 23 of Rules and Instructions relative to the Accounting System of the Naval Government of Guam by the United States in the Island of Guam and for such other banking business as may now or hereafter be authorized by law.

2. The Bank of Guam is authorized:

(a) To buy and sell drafts and deal in exchange in United States and Foreign currency.

(b) To receive money on deposit subject to acceptance by the Bank and to use such sums and deposits for purposes of loan and exchange for the mutual benefit of the bank and each of its several depositors.

(c) To make loans, not exceeding 75% of such deposits, of the money deposited under such rules as may be made by the Board of Managers and approved by the Chairman.

(d) To execute deeds of trust.

(e) To execute chattel mortgages upon ships and their cargoes or both.

(f) To perform all necessary acts to secure and safeguard loans.

(g) Provided, however, that no lean shall exceed 50% of the taxed value of land, nor more than 50% of the selling value of a ship or cargo or both.

3. The Bank of Guam will opened for the conduct of business with the public at 10:00 a.m., on January 3, 1916, and its business will be continued thereafter on each day of the calendar year, Sundays and legal holidays excepted. The Bank will be open to the public during the established hours of official business.

4. The Bank of Guam is authorized to open accounts with acceptable depositors and to receive deposits in sums of not less than five dollars ($5.00). The deposits will be classed as follows:

Deposits on which no interest will be paid and which will be subject to withdrawal by depositors at any time.

Deposits, withdrawals from which will be subject to 20 days notice, upon which interest at the rate of not more than 2% per annum shall be paid. Interest on such deposits shall be computed on monthly balances on the 1st day of each calendar month and credited to the depositor’s account. Accrued interest will be compounded annually on the first day of each fiscal year.

5. Certificates of Deposits for each sum of one hundred ($100.00) shall be issued to depositors whose deposits amount to one hundred dollars or more. The sum represented by each of these Certificates shall share in the annual net profits of the Bank. Fifty per cent of the annual net profits of the Bank of Guam shall be transferred to the Reserve Account of the Treasury of the Navel Government of Guam and the other 50% shall be prorated among all the Certificates of Deposit and the value of the amounts so prorated shall be credited to the accounts of the holders of the Certificates of record on the last day of each fiscal year.

6. The management of the Bank of Guam is vested in a Board of Managers composed of the Governor of Guam, who is ex-officio Chairman of the Board of Managers, the Pay Officer of the US Naval Station, Guam, who is ex-officio the Comptroller of the Bank, the Auditor for Guam, the Treasurer of the Naval Government of Guam and one holder of record of a Certificate of Deposit, as a representative of the depositors. This representative shall be elected by the holders of Certificates of Deposit, each holder casting one vote, a majority of votes being necessary for election. The meeting for the election of the representative of the depositors shall be held annually on the last Wednesday in June of each year and the depositor so elected shall assume the duties of his office on the succeeding first day in July and shall hold office for one year or until his successor shall have been elected and shall have qualified; provided, that the first representative of the depositors shall be appointed by the Governor of Guam to hold office until the election of a successor at the first election as herein provided for.

7. The Treasurer of the Naval Government of Guam shall act as the Cashier of the Bank of Guam and shall keep all accounts and records of the Bank of Guam separate and distinct from the other records and accounts of the Treasury. The accounts of the bank shall be audited by the Auditor for Guam, in accordance with the Rules and Instructions relative to the Accounting System of the Naval Government of Guam by the United States in the Island of Guam.

8. All laws and parts of laws inconsistent with the provisions of this Order are hereby repealed.

W. J. MAXWELL

Governor of Guam

To go back to the list of General Orders click here.